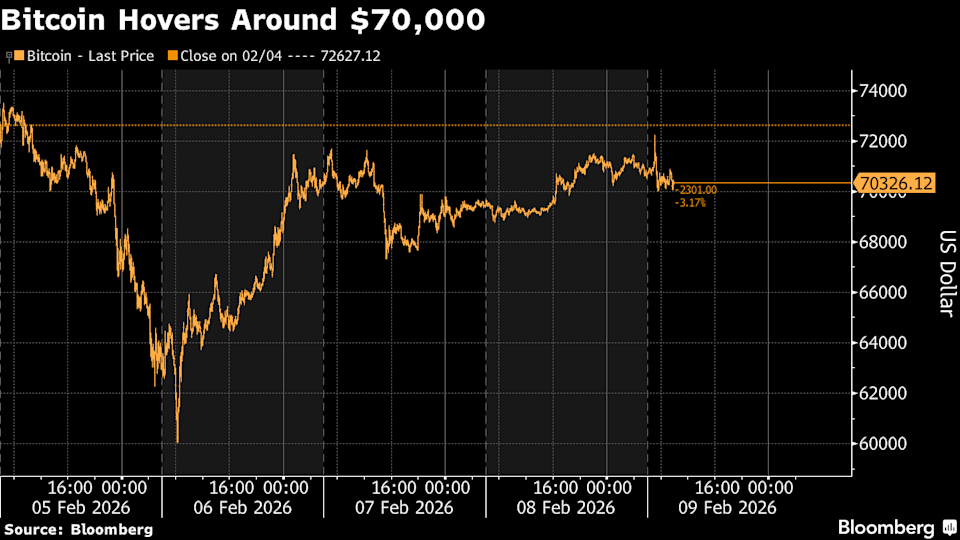

(Bloomberg) — Bitcoin slipped under $70,000 on Monday following a roller-coaster trip on the finish of final week.

The unique cryptocurrency — which had stabilized throughout the Asia day — fell round 1.1% to $69,864 at round 9 a.m. in London. The transfer was nonetheless comparatively calm in contrast with final week’s wild swings, when Bitcoin on Thursday plunged to $60,033, its lowest since October 2024, earlier than rallying again above $70,000 on Friday.

Most Learn from Bloomberg

Merchants stay on edge.

“Crypto markets have stabilized” however “the market continues to be unsure that the worst is over,” mentioned Caroline Mauron, co-founder of Orbit Markets. “$60,000 is the primary assist on the draw back. A break via $75,000 on the upside could sign the top of the bear market.”

Final week’s selloff noticed Bitcoin volatility surge. The Bitcoin Volmex Implied Volatility Index jumped above 97% within the largest intraday enhance because the collapse of Sam Bankman-Fried’s FTX in 2022.

Excessive volatility is nothing new to cryptocurrencies, however Bitcoin’s stoop from a peak of $126,000 in October final 12 months comes regardless of the backdrop of a crypto-friendly White Home and surging institutional adoption. Its failure to behave as a secure haven throughout a interval of heightened geopolitical uncertainty has raised doubts that it capabilities as a sort of “digital gold.”

Nonetheless, in a tentative signal of returning optimism, US Bitcoin exchange-traded funds recorded inflows of $221 million on Feb. 6 as buyers sought to purchase the dip following the market’s dizzying selloff.

“The temper within the crypto market at the moment can finest be described as guardedly constructive,” mentioned Sean McNulty, APAC derivatives buying and selling lead at FalconX. “Sentiment for the time being will not be overly bearish,” he mentioned, including the turbulence final week has “purged speculative froth” and left the market “buying and selling on stronger fundamentals.”

Offered Bitcoin stays above its 200-week transferring common of $58,000, which it bounced forward of on Friday, “there may be scope for the rebound to increase in direction of preliminary resistance at $73,000 to $75,000,” mentioned Tony Sycamore, a market analyst at IG Australia.

“A transfer above this degree would open the best way for the rebound to increase towards $81,000,” he mentioned.

Explainer: How Bitcoin’s Volatility Is Testing Crypto’s Enchantment

(Updates headline and story from first paragraph to mirror worth change.)

Most Learn from Bloomberg Businessweek