A sweeping crackdown on immigration in President Donald Trump’s second time period, characterised by elevated deportations and strict new visa bans, has precipitated an 80% collapse in web immigration to the U.S., in accordance with a brand new evaluation by Goldman Sachs. The report, launched Feb. 16, warns the dramatic contraction within the circulation of foreign-born staff is essentially altering the nation’s labor provide arithmetic and reducing the edge for job development wanted to keep up financial stability.

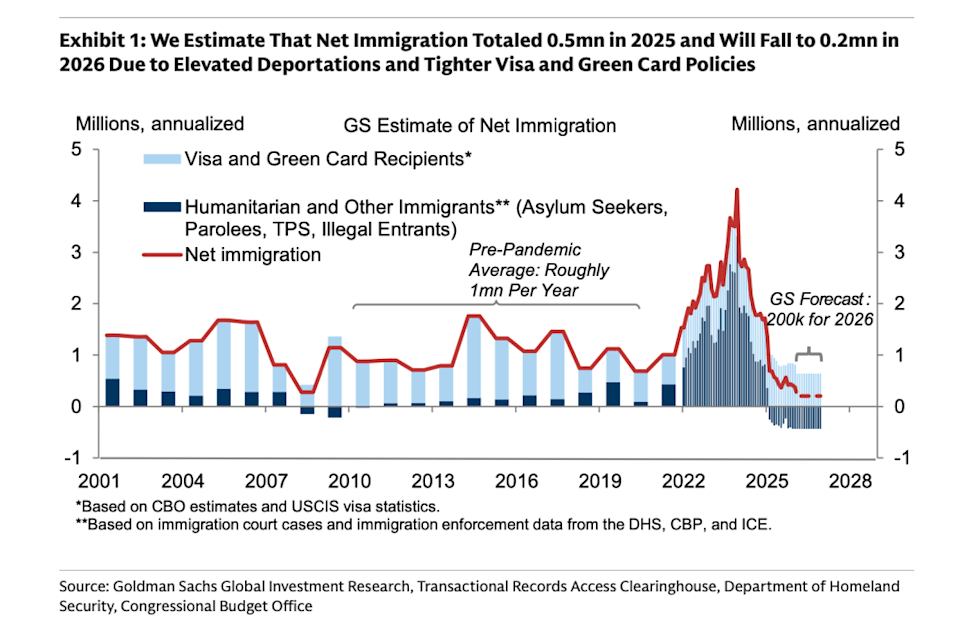

The funding financial institution’s U.S. economics workforce, in a report led by David Mericle, projected a precipitous drop within the arrival of latest staff. Whereas web immigration averaged roughly 1 million individuals per 12 months throughout the 2010s, that determine fell to 500,000 in 2025 and is projected to plummet additional to simply 200,000 in 2026, Goldman mentioned. That represents an 80% decline from the historic baseline, a shift the report attributes on to aggressive coverage adjustments, together with “elevated deportations,” a just lately introduced pause on immigrant visa processing for 75 international locations, and an expanded journey ban.

The economists be aware these measures are more likely to “sluggish inflows of visa and inexperienced card recipients” considerably, whereas the “lack of Momentary Protected Standing for immigrants from some international locations” poses additional draw back dangers to the labor provide. The report explicitly hyperlinks the forecasted drop to elevated deportations and tighter visa and inexperienced card insurance policies.

This extreme restriction of the labor pipeline is forcing economists to recalibrate their benchmarks for the U.S. economic system. As a result of fewer immigrants means fewer new staff are coming into the labor drive, the economic system requires fewer new jobs to maintain the unemployment charge secure. Goldman Sachs estimates this “break-even charge” of job development will fall from its present degree of 70,000 jobs monthly to simply 50,000 by the top of 2026.

“Labor provide development has declined sharply as immigration has fallen from the height reached in late 2023,” Mericle’s workforce wrote. Consequently, a month-to-month jobs report which may have seemed weak in earlier years might now sign stability. “A small pickup is all that needs to be wanted to maintain job development on the break-even tempo,” the analysts wrote, suggesting the decrease provide of staff is masking what would possibly in any other case be seen as sluggish hiring demand.

These lacking staff have prompted appreciable debate—even nervousness—in financial ranks, as lowered immigration has been but extra noise within the financial knowledge, together with the “shrinking ice dice” of Trump’s tariff regime and the boom-or-bubble debate over synthetic intelligence.

The rising productiveness from fewer staff leads some, corresponding to Stanford’s influential Erik Brynjolfsson, to see a liftoff occurring from AI instruments, whereas others see a hinge second by which Massive Enterprise is getting ready to do to white-collar staff within the 2020s what it did to blue-collar staff within the Nineteen Nineties and massively downsize. This analysis from Goldman suggests the economic system is studying the best way to make do with out the essential layer of immigrant labor that fueled the final regime. Certainly, Mericle’s report was titled, “Early steps towards labor market stabilization.”

Different economists have just lately projected the economic system is nearing a break-even level whereas creating fewer jobs, notably Michael Pearce of Oxford Economics. Final August, J.P. Morgan Asset Administration strategist David Kelly predicted there might very probably be “no development in staff in any respect” over the subsequent 5 years owing to the change in immigration to the U.S. and the growing older of the native-born workforce.

The crackdown can also be pushing the labor market into the shadows, Mericle discovered. The report means that “stricter immigration enforcement pushes extra immigrant staff to shift to jobs that fall outdoors of the official statistics,” probably skewing federal knowledge. This shift complicates the Federal Reserve’s potential to gauge the true well being of the economic system, as official payroll numbers might fail to seize the complete image of employment exercise.

It could actually clarify why the headline unemployment charge seems to be stabilizing round 4.3% (it just lately dipped to 4.28%), though Goldman mentioned the labor market stays “shaky” due to these unpredictable components. The report highlights a “notable drop in tech employment,” though it clarifies the sector accounts for a comparatively small share of total payrolls. Extra regarding is the “continued decline in job openings,” which have fallen beneath pre-pandemic ranges to roughly 7 million.

In a separate be aware, Goldman chief economist Jan Hatzius maintained a “reasonable” recession likelihood of 20% for the subsequent 12 months. The agency anticipated the labor market to stabilize, predicting the unemployment charge will rise solely barely to 4.5%. Nonetheless, they warned, dangers are “tilted towards a worse consequence,” largely owing to the weak place to begin for labor demand and the potential for “quicker and extra disruptive deployment of synthetic intelligence.”

This story was initially featured on Fortune.com